Special Charge Formulas Table - FIL 49

Example of Two Service Charges

Example Of Two Special Charges

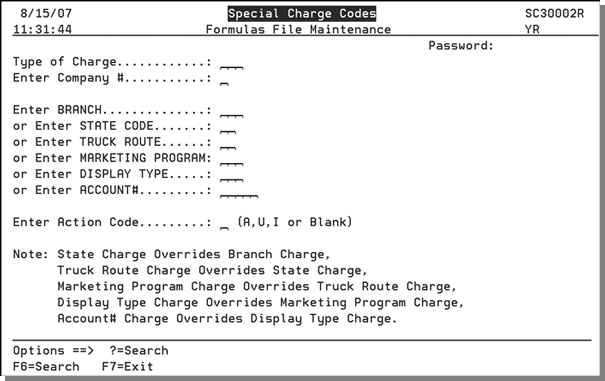

The Special Charges Formulas Table enables you to define which customers are affected by each special charge, and how that charge is calculated. The Special Charges Formulas can vary for the same special charge code, based on branch, state, marketing program, and other criteria. For example, special charges for Fuel Surcharges can be different in each of your branches, different based upon marketing programs, customer account number, etc.

Use this screen to create or update special charge codes. The fields on this screen are described in the following table.

|

Field |

Description |

|

Type of Charge |

Enter the three character code for the special charge. Each code carries a description that appears on invoices and in accounting transactions when this code is used. Charge codes are created through the Special Charge Codes Table - FIL 48. |

|

Company |

Enter the Company number that the special charge will apply to. |

|

Enter BRANCH or Enter STATE CODE or Enter TRUCK ROUTE or Enter MARKETING PROGRAM or Enter DISPLAY TYPE or Enter ACCOUNT# |

Assign the charge by one of these parameters. You can only assign the charge to one parameter at a time. If you enter a branch, the charge applies to all customers in that branch. If you enter a state (or province) code, the charge applies to all customers in that state, and so on. The file is arranged hierarchically.

If you have the same special order charge for all customers except for one in a branch, you can create a record to cover all customers in that branch. Then, you can create record by account number to account for the exception. If you have a special charge that applies to two branches, then create two records in this file, one for each branch. |

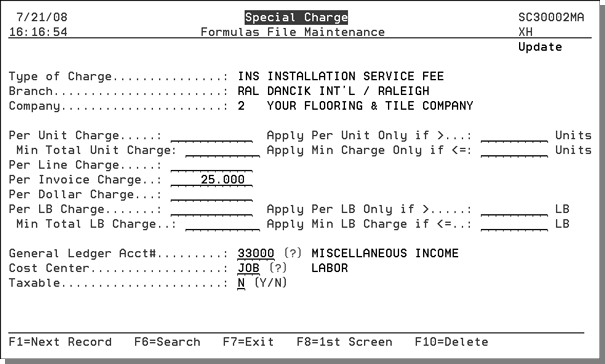

After entering the necessary information, press Enter. The second screen in the process appears.

One or multiple charges can be applied to the entire order or to individual lines on an order; depending on lines meeting the criteria in the Special Charge Code and Special Charge Formula Tables.

|

Field |

Description |

|

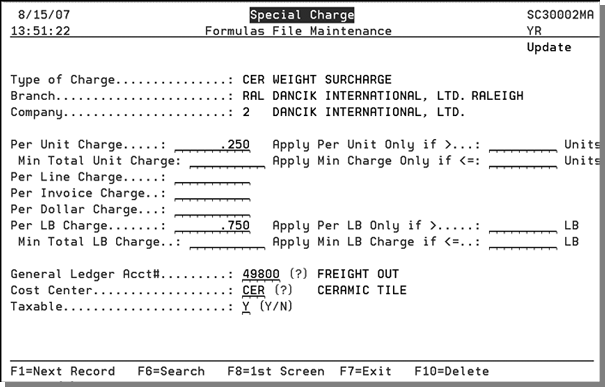

Per Unit Charge |

An entry of .250 means charge $.25 per unit sold (unit of measure). This always applies to the native U/M of each item. |

|

Apply Per Unit Only if > ....Units |

If you enter a quantity of units in this field, then the Per Unit Charge will only be applied if the quantity ordered is greater than this quantity. |

|

Min Total Unit Charge |

Enter an amount that will be assessed as a minimum total of per unit charges. For example, if the Min Total Unit Charge is $10.00 and the Per Unit Charge multiplied by the number of units is less than $10.00 then $10.00 is charged. The field Apply Min Charge Only if <= lets you enter a unit amount that will activate the minimum total unit charge. |

|

Apply Min Charge Only if <= ..... Units |

If you enter a quantity of units in this field, then a Minimum Total Unit Charge will only be applied if the quantity ordered is less than or equal to this quantity. For example, if $5.00 is entered into the Min Total Unit Charge field and the quantity ordered x the per unit charge is $5.00 the minimum total unit charge will not be applied. |

|

Per Line Charge Per Invoice Charge Per Dollar Charge |

Enter the amount you want added for each of these parameters. Examples:

If you are using IWMS, and the order line is split between two locations, the special charge does not accrue to each split line even if invoice consolidation is turned on.

|

|

Per LB Charge

Apply Per LB Only if >_____ LB |

These fields work together to assess a charge based on the weight of the delivery. For example, entering 0.05 in the Per LB Charge and 500 in the Apply Per LB Only if > ______ directs the system to add $.05 for every pound on the order if the weight total is over 500 pounds. If the Apply Per LB Only if > ______ field is left blank, the system assumes that the per LB charge applies to all applicable lines, regardless of total LBs. |

|

Min Total LB Charge

Apply Min LB Charge if <=..... LB |

Enter an amount that will be assessed as a minimum total LB charge. The field Apply Min Total LB Charge Only if <= lets you enter a pound amount that activates the minimum total weight charge. For example, if 10.00 is entered into the Min Total LB Charge field and the Apply Min Total LB Charge Only if <= is set to 100, the minimum total LB charge is applied if the total applicable weight is < = 100 LB. |

|

General Ledger Acct# |

Enter the general ledger account number to which this charge should post. |

|

Cost Center |

Establishes the cost center for the charges. Cost Centers define the different aspects of a business for the purpose of analysis. They are created and maintained via the Cost Center File (FIL 10). |

|

Taxable |

Enter a Y if the special charge is taxable. |

Example of Two Service Charges

In this example, we are setting up two service charges that can be used independently or both on the same order.

- An installation service surcharge for small installations

- An estimating charge, based upon the order type entered on the Order Header screen.

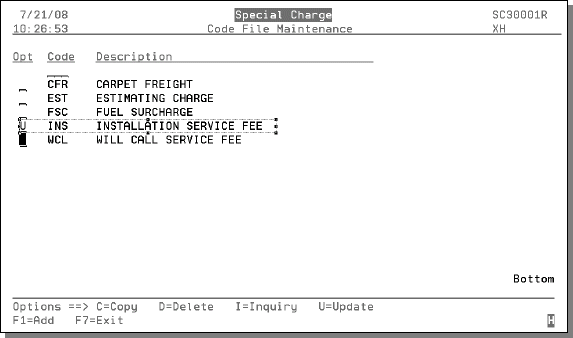

Setting up the Installation Service Surcharge

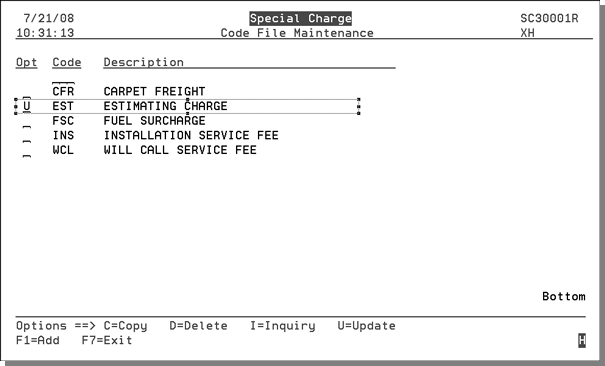

- On the Special Charge Codes Table (FIL 48), create and/or update a code or this special charge. In this example, a code exists.

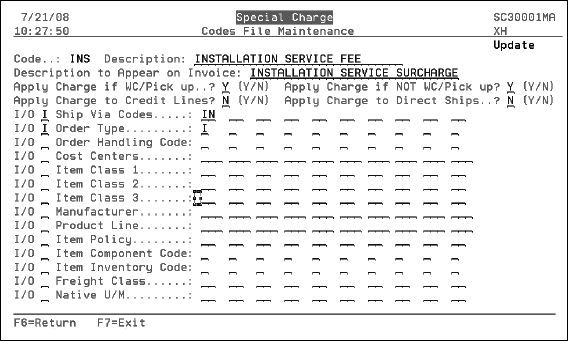

- The next screen to appear lets you pick the parameters you want to include (or exclude) in the Special Charge. In this example, when orders with a Shipvia code of IN (installation) and an Order Type of I are invoiced the Installation Service Fee is assessed.

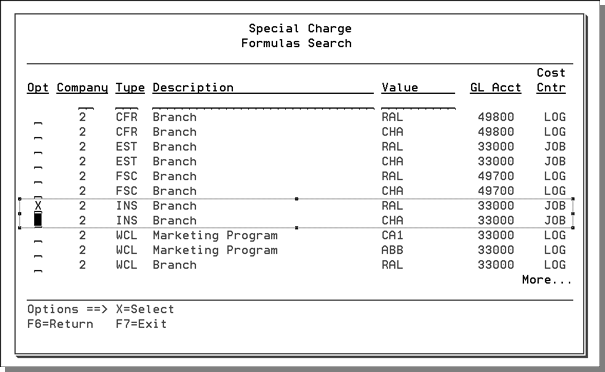

- The next step is to define the special charge (INS). This is done via the Special Charge Formulas Table (FIL 49). When you enter into the program, press F6 to search through the existing codes for the INS code.

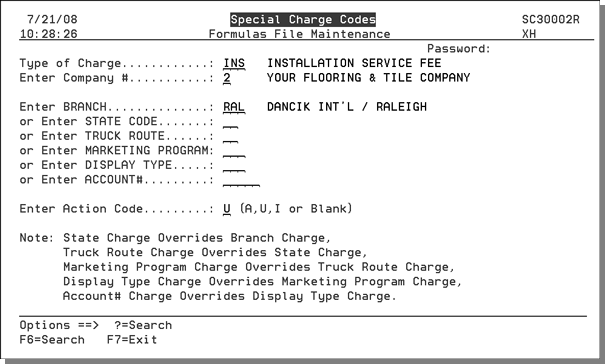

- Select to access the Formulas File Maintenance screen. Enter a U in the Enter Action Code field to update the special charge.

- In this example, invoices for installation orders (shipvia = IN, order type = I) are assessed a $25.00 Installation Service Surcharge.

If there was not a code for installation, one can be created by pressing F1.

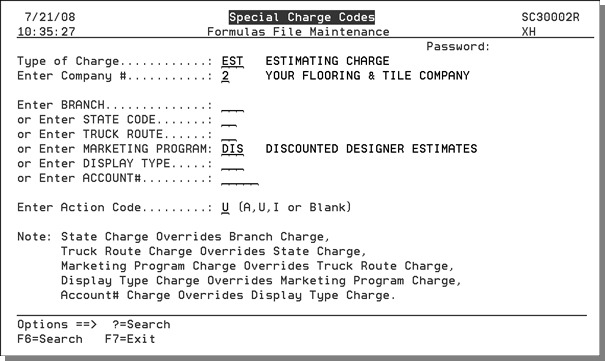

Setting up the Estimation Special Charge Surcharge

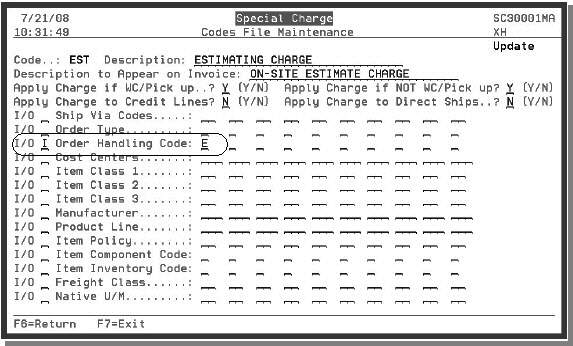

- On the Special Charge Codes Table (FIL 48), create and/or update a code or this special charge. In this example, a code exists. If there was not a code for installation, one can be created by pressing F1.

- The next screen to appear lets you pick the parameters you want to include (or exclude) in the Special Charge. In this example, if an order has an Order Handling Code of E the invoice for the order will include an Estimating Charge.

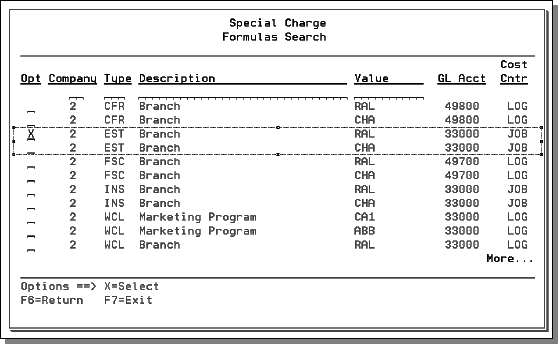

- The next step is to define the special charge (EST). This is done via the Special Charge Formulas Table (FIL 49). When you enter into the program, press F6 to search through the existing codes for the INS code.

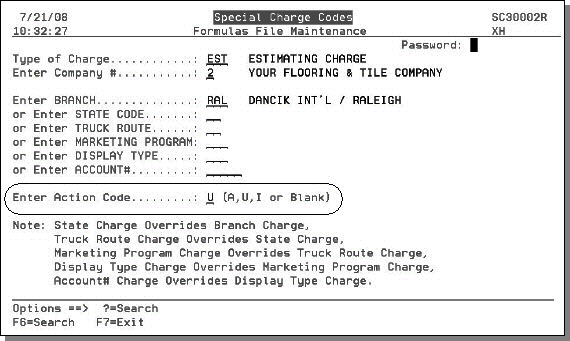

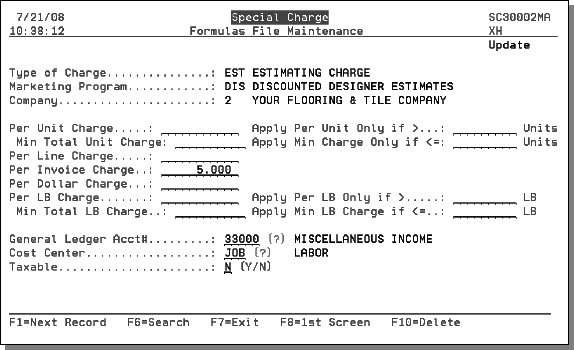

- Select to access the Formulas File Maintenance screen. Enter a U in the Enter Action Code field to update the special charge.

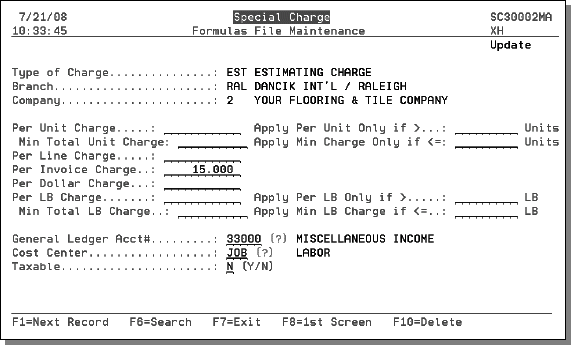

- In this example, invoices for estimates (Order Type = E) are assessed a $15.00 Estimation Fee.

- To add another Estimation fee based on a marketing program, return to the Formulas File Maintenance screen and enter the Marketing Program.

- Enter a U in the Enter Action Code field to access the following screen.

- When you perform a search of the available Special Charge Formulas (FIL 49 then press F6), notice there can be several special charges under the same heading (ESTimating) based on different criteria (marketing programs, branch, state, etc.).

The Order Handling Code is assigned via the O/H field on the Order Header.

Example Of Two Special Charges

In this example, we are going to create two special charges. The first is to cover the freight cost for carpet and the second is a will call service fee. Both of these fees can be assessed on the same invoice.

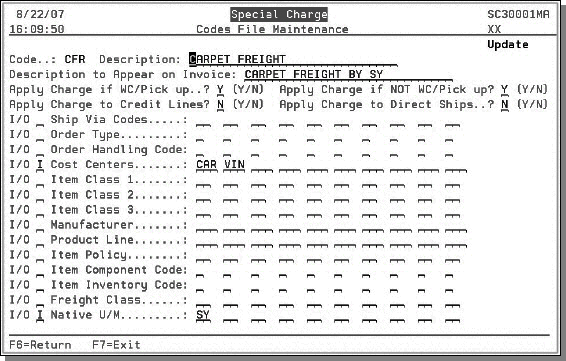

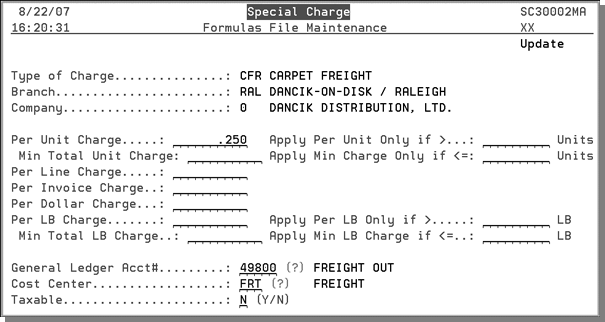

Special Charge Record for Carpet Freight

In this example:

- the carpet freight charge is applied to any line item that is in the carpet cost center

- if the native U/M is SY

- and the line is not a credit or direct ship

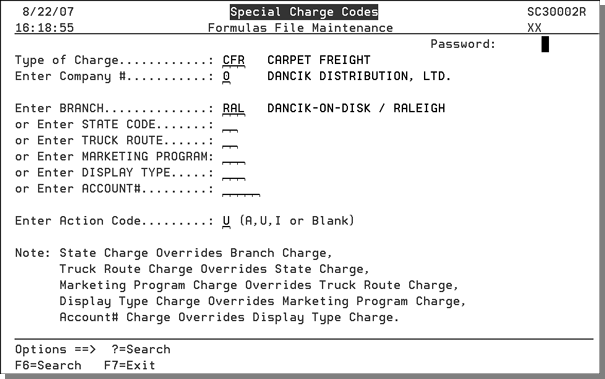

Enter the Type of Charge, Company, Branch, and Action Code.

This carpet charge applies to all customers in branch RAL.

Because this charge applies to all customers in the Raleigh branch, the Branch field is used.

Press Enter. A $0.25 per SY charge is set up for carpet that is sold by the SY.

This formula simply adds .25 per unit to each applicable line item, which (based on your Special Charge Code Table entries) relates to carpet with a native U/M of SY only.

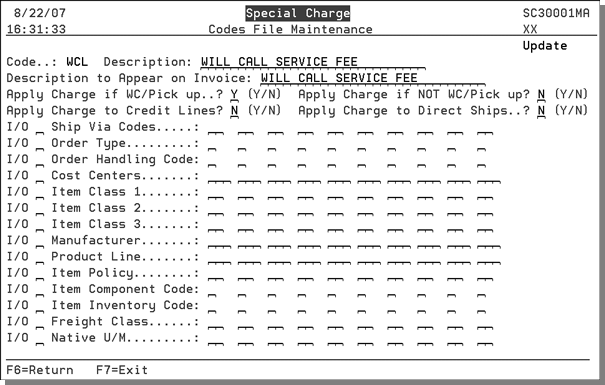

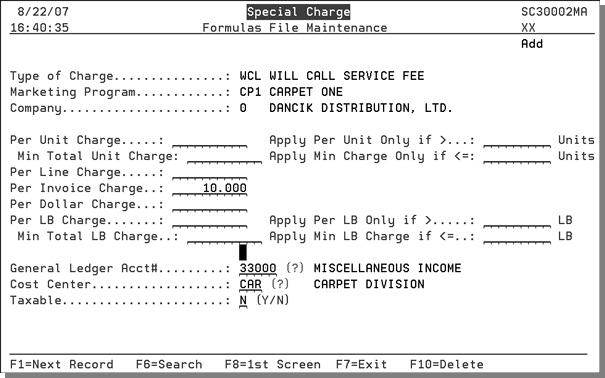

Special Code Record for Will Call Fee

In this example, the will call charge of $10.00 is applied to any will call orders (as defined in the Classification Codes File - CUS 19), but does not apply if a credit or direct ship.

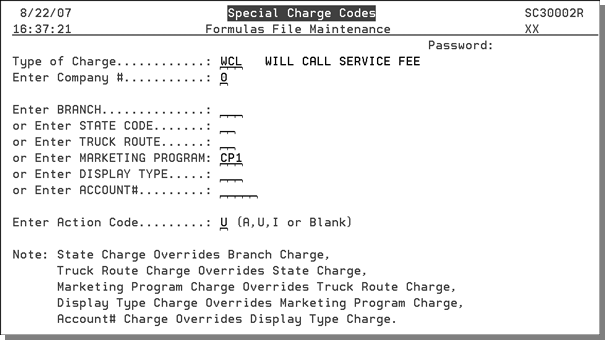

Enter the Type of Charge, Company, Marketing Program, and Action Code.

The will call charge only applies only to specific marketing programs (CP1).

Press Enter.

Examples of how these entries affect invoicing

- If an invoice was generated for a delivery of 100 SY of carpet, 50 SY of another carpet, and 1000 SF of wood, the special charge on the invoice would be: CARPET FREIGHT BY SY 150 SY = 37.50.

- Note: 150 SY x .25 SY = 37.50.

- For an invoice for 1000 SF of wood, that is a will call for a Carpet One dealer, the special charge on the invoice would be: WILL CALL SERVICE FEE = $10.00.

- If an invoice was generated for an order that had: 100 SY of carpet, 50 SY of another carpet, and 1000 SF of wood, that was a will call for a Carpet One dealer, the special charges on the invoice would be:

- CARPET FREIGHT BY SY 150 SY = 37.50.

- WILL CALL SERVICE FEE = $10.00.